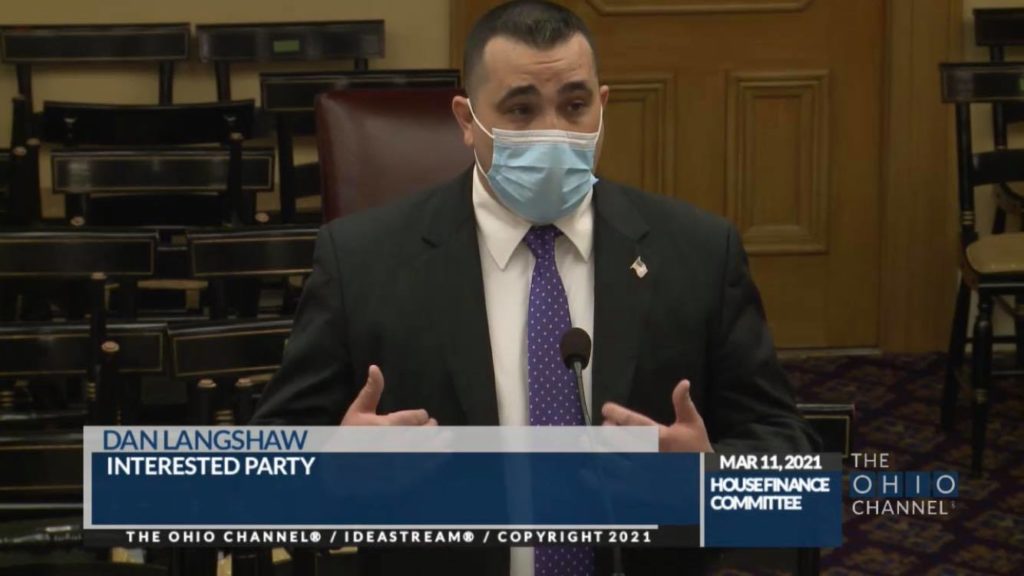

Former North Royalton Ward 3 Councilman Dan Langshaw and former Treasurer for the Northeast Ohio City Council Association testified before the Ohio House Finance Committee on House Bill 110 the state operating budget for FY 2022 and FY 2023 at the Statehouse in Columbus, Ohio on March 11, 2021. He urged lawmakers for more COVID-19 relief funding for local governments, small businesses, and Ohioans in the budget. He also described what areas of the budget were positive and other areas needing to be improved upon before the General Assembly approves the overall state budget before the June 30th deadline.

Click Here to view Dan Langshaw’s full testimony.

Click Here and forward to the 55:56 mark to view the video of Dan Langshaw’s testimony.

Honorable Dan Langshaw House Bill 110 Testimony Ohio House Finance Committee March 11, 2021

Chairman Oelslager, Vice Chair Plummer, Ranking Member Crawley, and House Finance Committee members. My name is Dan Langshaw, I am a former North Royalton City Councilman and former Treasurer for the Northeast Ohio City Council Association. Thank you for the opportunity to testify on House Bill 110 the State Operating Budget for FY 22 and FY 23.

I testify today as an interested party regarding this next biennium budget. There are things that I believe are good for local communities like mine and there are things that I believe this committee should consider amending to make the budget better for local governments and communities throughout Ohio.

We all know first-hand the negative impact the COVID-19 pandemic has had on all Ohioans, businesses, and local governments. This budget reflects a very positive commitment by all of you here in the General Assembly to begin a historic relief process that our state has never seen before. There are three areas of the budget that I believe are extremely helpful. They are as follows:

Small Business

According to a survey done a few months ago by the US Chamber of Commerce, 43% of small businesses surveyed believe that they have less than six months until a permanent shutdown is unavoidable during this pandemic. In my city of North Royalton we have seen this sad statistic play out as we have lost a number of our small businesses due to the pandemic. We have also experienced an unemployment rate of 11.2% for 2020 verses a 4.2% in 2019. The proposed $460 million in the budget would offer grants for small businesses hardest hit by the pandemic. Breaking it down further, the $200 million would be catered towards bars and restaurants, $150 million for small businesses, and $20 million for new businesses will significantly help COVID-19 relief efforts.

Infrastructure

Many of you on this committee have served in local government at one time and can recall one of the most common questions your constituents would ask you is “Can you fix my street?” In Northeast Ohio where I am from, we get hit hard by Mother Nature during the winter. This takes a toll on our public roadways with potholes, in addition to the continued challenges of addressing repairs on our aging infrastructure. On average, my community of North Royalton spends about $1 million annually on repairing our local roads. However, with aging infrastructure needs those costs rose in 2019 causing the city to spend about $2.8 million on road repairs. So the $450 million in this budget for local infrastructure projects will greatly help during these tough economic times and provide some good shovel ready jobs in the process too.

Law Enforcement

Public safety makes up the largest part of any municipal budget throughout Ohio. When I served as Chair for the Safety Committee in my tenure on city council, I sponsored legislation in 2019 for my city for the first time to equip our 35 police officers with body cameras and 15 police vehicles with dash cameras in our city’s history. The purchase of this equipment from BodyWorn will cost my city about $247,100 over five years. (See attached January 14, 2020 Cleveland.com article) Many other communities throughout Ohio are in the same position. So the $10 million proposed in this budget would fund a grant program to help local law enforcement agencies who do not have cameras. Both will help provide relief to local governments and improve public safety in Ohio.

There are two areas of the budget that standout needing to be amended to improve the overall biennium budget and COVID-19 relief efforts. They are as follows:

Governor’s Ohio Ad Campaign

Governor Mike DeWine in his original budget proposes $50 million for an ad campaign trying to persuade people to move to Ohio, particularly from higher cost states. As a fiscal conservative and listening to fellow residents this just seems to be wasteful spending. Where such money could be better used to provide additional relief to small businesses, local governments, or direct relief to Ohioans. Please take this out of the budget, reallocate this funding to more urgent priorities, and urge the Governor to persuade the private sector to do such ads but not at taxpayer expenses.

Local Government Fund (LGF)

Since 2011, the state has made deep cuts to the Local Government Fund by slashing it in half from 3.68% to 1.66% today. Last biennium budget back in 2019 in which I testified, it was positive to see the General Assembly approve HB 166 with a slight increase to LGF. However, this biennium the Governor proposed $425 million in FY 22 and $440 million in FY 23 to the LGF. Disappointingly this is going backwards on the progress made by HB 166 by returning the Local Government Fund to the statuary level of 1.66%. (See attached LSC February 4, 2021 Revenue Forecast page 11)

As a result, my own city of North Royalton has experienced approximately over $7 million dollars in state local government funding cuts since 2011. (See attached is a chart of a breakdown of those cuts since 2011). On top of a 2021 city budget for my community factoring in the impacts of the pandemic with a -3% decrease in 2020 income taxes and additional decrease this year of -1.5% decrease or about $235,000 less is a big impact on any local government in Ohio. (See attached North Royalton City Budget 2021 Projected Revenues) I propose that this committee uses funds from the Governor’s Ad Campaign or tap some money from the state’s rainy day fund at a minimum to keep the FY 2020 and FY 2021 LGF Levels in place for this biennium or higher than the 1.66%.

In closing Representatives, the decade of cuts in the local government fund, decline of the CAT tax, and elimination of the estate tax, and the negative economic impact of COVID-19 pandemic all highlights the importance that the General Assembly include as much COVID-19 relief in this budget so Ohio can successfully recover whether you are a small business, local government, or just an ordinary Ohioan.

Thank you for the opportunity to speak to you. I am happy to answer any questions you may have for me at this time and am available via email at danlangshawfornrward3@yahoo.com